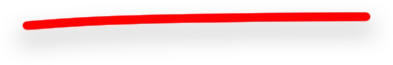

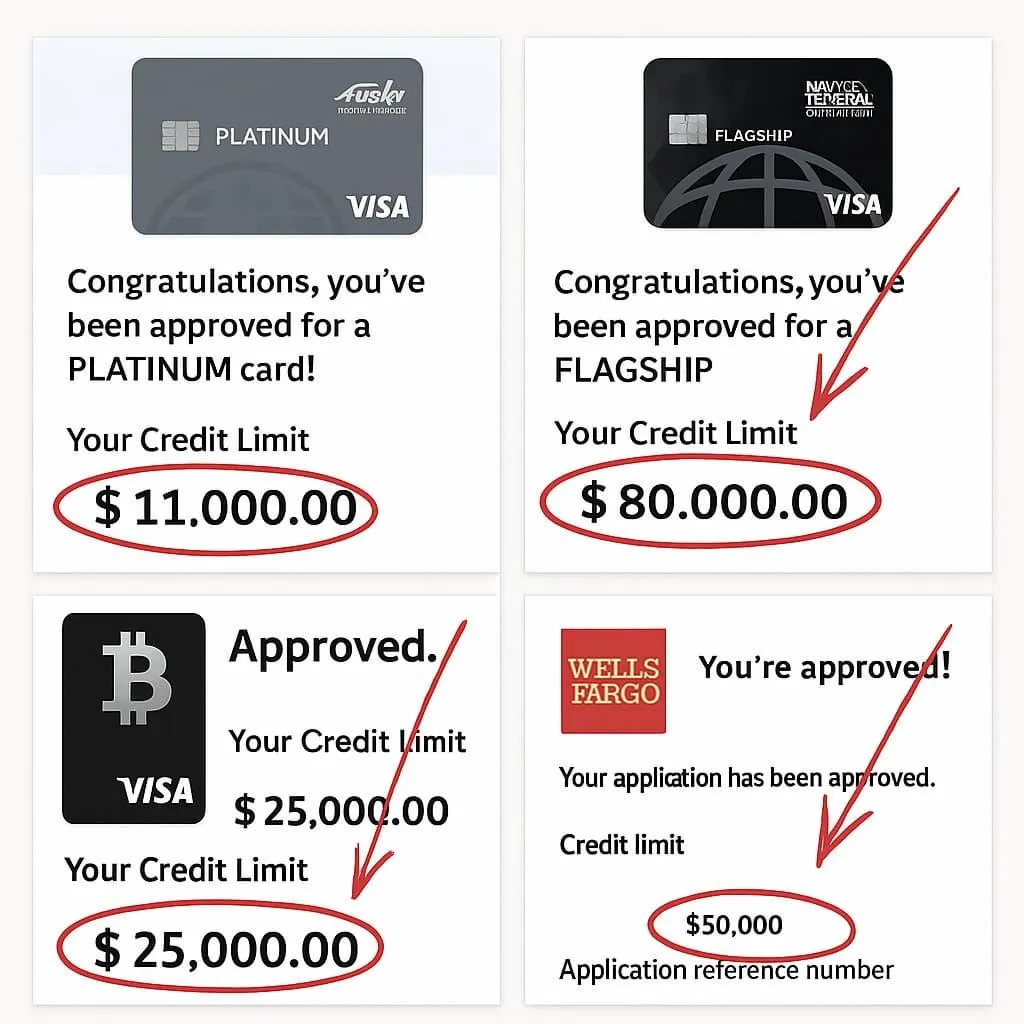

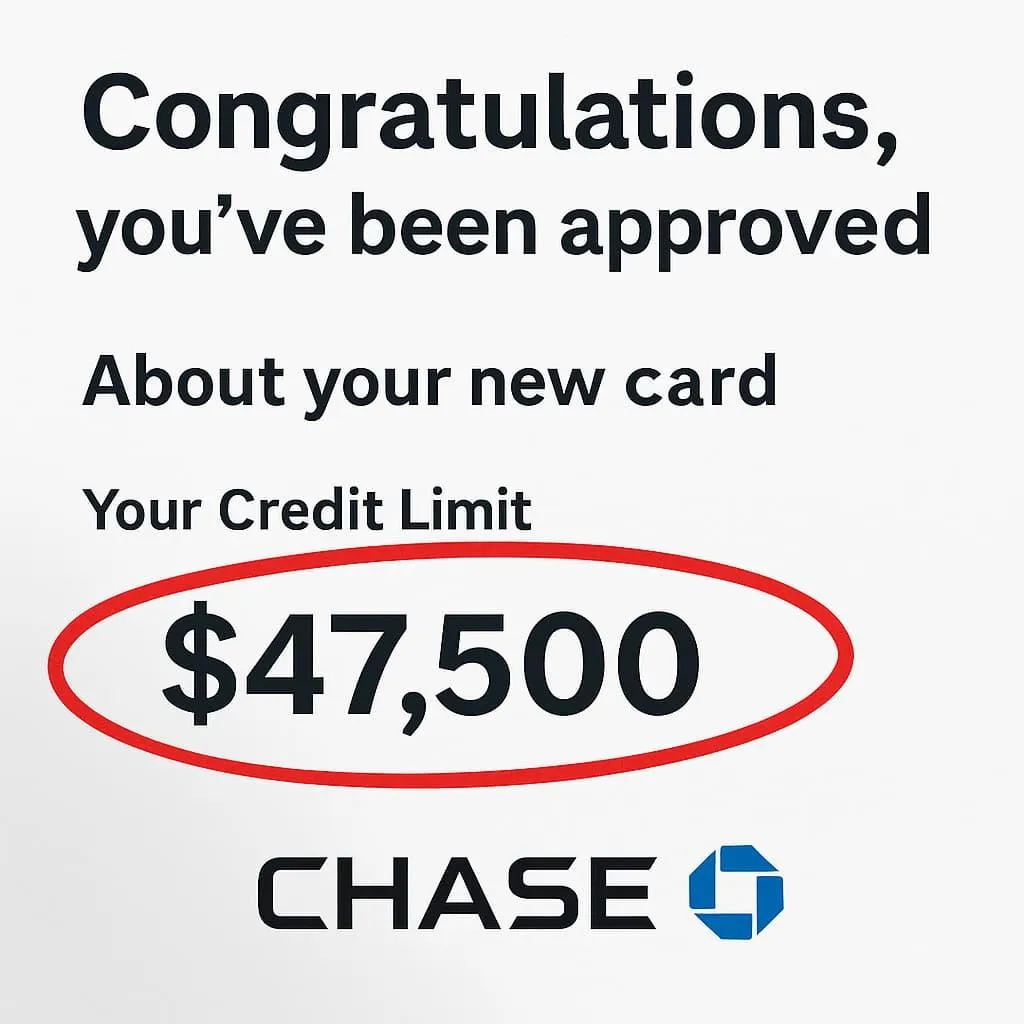

helped 4,700+ entrepreneurs unlock $50K–$100K in business credit

Most Business Owners Who Get Denied for Funding

Actually SHOULD Have Been Approved

Even if you’ve been denied before.

Even if your LLC is new.

Even if your personal credit isn’t perfect.

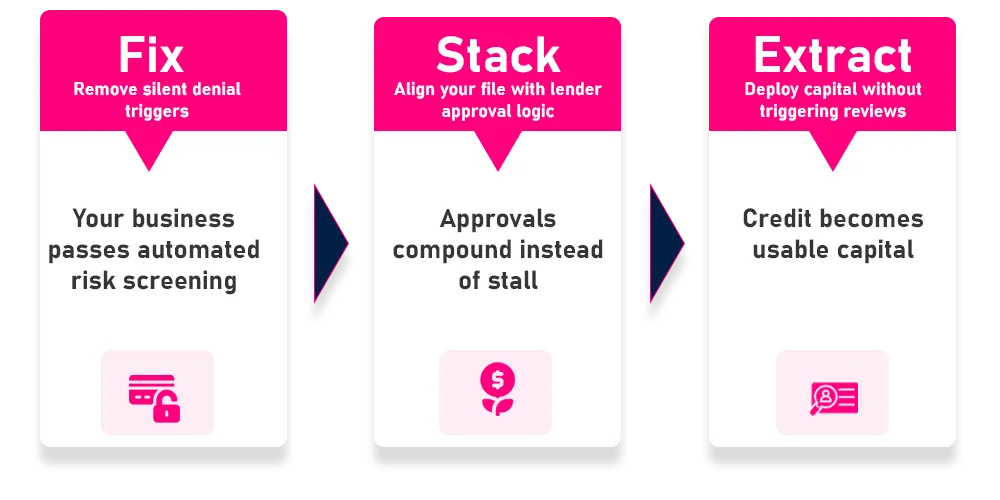

The 3X Business Credit System™

Banks don’t reject businesses because they’re risky.

They reject them because of silent data mismatches you were never told about.

If your business is “clean” but keeps getting denied, stalled, or ghosted…

this page will explain exactly why — and how to fix it.

⬇️ Start with a 60-second funding readiness scan ⬇️

Before You Go Any Further — Check This First

This is for you if any of the following are true:

✔️ You formed an LLC correctly but still get denied

✔️ You opened a business bank account but approvals stalled

✔️ You’ve applied to Amex, Chase, Truist, Divvy, or Brex and heard nothing

✔️ Your business “looks fine” but funding won’t move

✔️ You’ve been told “build tradelines” but nothing changed

If none of these apply, this isn’t for you.

But if even one does — you’re not broken.

Your business is sending the wrong signals.

Get approved by real banks using the exact system that’s helped 4,700+ entrepreneurs unlock $50K–$100K in business credit under their EIN — not their SSN.

No begging.

No guesswork.

No “submit and pray.”

Just the signal banks are trained to approve.

Why Funding Feels Random (But Isn’t)

(And Why It Has Nothing to Do With Hustle, Revenue, or Luck)

Most business owners assume they were denied because they didn’t qualify.

That’s almost never the real reason.

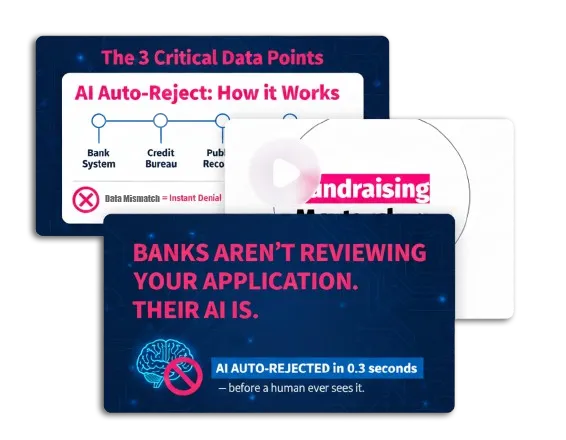

In reality, by the time a bank ever looks at your application, an automated underwriting system has already made a decision.

Not based on hustle.

Not based on revenue.

Not based on your story.

It’s based on whether your business sends the correct approval signals across the data sources banks quietly check.

Most entrepreneurs never learn this

because banks never explain it.

Here’s the truth:

Banks aren’t reviewing your application. Their AI is.

And if your business identity data doesn’t match perfectly across their systems, the AI auto-rejects you in 0.3 seconds — before a human ever sees it.

This isn’t about:

Revenue

Time in business

Or your grind

It’s about the approval signal your business is sending.

Fix the signal → The approvals start.

What Banks Never Explain

Banks aren’t evaluating your story.

They’re evaluating data alignment, sequencing, and risk signals — and over 90% of denials happen before a human ever sees your file.

If an underwriting system detects even one silent mismatch, your application stalls or auto-denies instantly.

Common triggers include:

❌ Mismatched business addresses across bureaus

❌ High-risk NAICS code (without you knowing it)

❌ Incomplete DUNS file

❌ Wrong business email (yes, this is real)

❌ No deposit history with the bank

❌ You applied to the wrong bank first and triggered a blacklist

Once that happens, you don’t get feedback.

You just get a “No.”

The Real Difference Between Denied and Approved Businesses

It’s not credit.

It’s not time in business.

It’s not revenue.

It’s whether the business sent the right signal at the right time in the right order.

The businesses unlocking $50K–$100K didn’t get lucky.

They followed a system designed around how underwriting actually works.

Sound Familiar?

❌ You’ve been told to get Net-30s, but they didn’t report anything

❌ You opened a business account and still got denied

❌ You applied for Amex, Truist, or Divvy and got ghosted

❌ You’re watching people with brand new LLCs get $50K and wondering: WTF am I missing?

The truth is: they sent the right signal. You didn’t.

This Isn’t Theory, It’s Pattern Recognition

This system has been used by:

• New LLCs with under 90 days of history

• Service businesses doing under $10K/month

• Consultants with no physical location

• E-commerce brands denied multiple times

• Agencies that looked “risky” on paper

Across 4,700+ businesses, the pattern was the same:

The business wasn’t risky.

The signals were wrong.

Once fixed, approvals followed.

That’s What the 3X Business Credit System Was Built to Do

Fix. Stack. Extract.™ Method

How This Actually Works

You don’t apply to banks first.

You fix what banks check before you ever apply.

The 3X Business Credit System™ walks you through a proven sequence:

1️⃣ Fix the invisible data conflicts triggering auto-denials

2️⃣ Stack applications in the exact order banks reward

3️⃣ Extract usable capital without triggering shutdowns or reviews

This turns funding from a gamble

into a predictable process.

The Fix Phase:

Clean the invisible data conflicts that cause instant auto-denials — even when your credit is good.

The Stack Phase:

Apply in a proven bank order that triggers internal trust scores and automatically unlocks larger approvals as you move up the ladder.

The Extract Phase:

Turn credit limits into real, spendable capital — safely — without triggering shutdowns, cash-advance flags, or account holds.

This is the same acquisition pattern responsible for unlocking over $100M+ in business funding across agencies, coaches, e-com brands, consultants, contractors, trucking, restaurants, service companies, and new LLCs with little or no history.

This alone is worth the entire investment.

Because once you know this pattern → funding becomes predictable.

What You Get Inside the 3X Business Credit System™

To complete your Funding Readiness Scan and unlock your personalized roadmap, you’ll get full access to the 3X Business Credit System™, CreditMind AI™, and all bonuses today for just $37.

The complete, step-by-step system that shows you exactly how to get $50K–$100K in real business credit under your EIN not your SSN.

Inside, you’ll learn:

🔥 Fix – Clean the invisible red flags silently killing your applications

🔥 Stack – Apply in the exact lender order to unlock bigger approvals faster

🔥 Extract – Turn credit lines into usable cash for inventory, ads, or equipment

This is the blueprint behind over $100M in business funding unlocked and it’s finally available for everyday entrepreneurs.

($497 Value — Included Today)

This is the proven Fix. Stack. Extract.™ method that turns your business into a bank-approved credit profile — even if you’ve been denied in the past.

✔️ The Fix Phase removes hidden denial triggers

✔️ The Stack Phase triggers approval momentum

✔️ The Extract Phase turns credit into deployable capital

This is the foundation.

You’re already set this alone will get you funded.

But I don’t play small.

We’re going to make this stupid-simple to execute — no guesswork, no ‘trial and error’, no stress.

Bonus #1 — Business Identity Compliance Pack™

($147 Value)

Fix the silent data issues that trigger auto-denials.

Banks don’t deny businesses — their systems flag inconsistencies.

This module cleans the invisible identity mismatches that cause instant rejections, even when your credit is solid.

Inside, you’ll get:

✔️ Authority Sheet™ Business Identity Template

✔️ Identity Sync Sweep SOP (14–28 day alignment process)

✔️ Red-Flag Decoder (the most common auto-deny triggers to remove)

Outcome:

Your business presents as clean, stable, and verifiable across the data sources underwriting systems actually check.

This completes the Fix stage.

Bonus #2 — Approval Sequencing & Bank Target Matrix™

($197 Value)

Apply in the correct order — or don’t apply at all.

Most denials happen because entrepreneurs apply to the wrong bank at the wrong time.

This module removes guesswork and replaces it with a proven approval sequence.

Inside, you’ll see:

✔️ A tiered bank application order

✔️ Which lenders to approach first — and which to avoid early

✔️ The relationship signals banks look for before issuing real limits

Outcome:

You stop gambling with applications and start building approval momentum.

This powers the Stack stage.

Bonus #3 — 0% APR Expansion & Float Strategy™

($147 Value)

Access credit safely — without triggering reviews, shutdowns, or flags.

Getting approved is only half the battle.

Using credit the wrong way can shut everything down.

This module teaches bank-friendly access strategies that protect your profile while giving you real working capital.

Inside, you’ll learn:

✔️ Safe float rotation principles

✔️ Statement timing and payment behavior banks prefer

✔️ How to use 0% APR tools without triggering risk alerts

Outcome:

Credit becomes usable capital — without putting your accounts at risk.

This completes the Extract stage.

Bonus #4 — CreditMind AI™ Diagnostic Assistant

($197 Value)

Your personal approval-signal intelligence layer.

Instead of guessing what’s wrong with your file, you can see it.

CreditMind AI analyzes your uploaded business profile and tells you exactly what needs to be fixed — and in what order.

Inside, you get:

✔️ Upload-based business identity scan

✔️ Personalized fix-first priority list

✔️ Correction and dispute guidance where applicable

Outcome:

You move forward with clarity instead of trial-and-error.

This accelerates Fix and prevents bad applications.

Bonus #5 — The Credit Command Center Dashboard

($97 Value)

Manage your entire business credit profile in one simple control panel — no guesswork.

✔️ Trade Line & Reporting Tracker

✔️ Application & Inquiry Log

✔️ Deposit Rhythm & Banking Behavior Monitor

✅ Keeps you on track through every stage.

Bonus #6 — Fundability Scan™ (Live Business File Check)

($197 Value)

Certainty before you apply.

Before you submit applications, we review your business file and confirm what’s blocking approvals — and what’s ready.

This is not coaching and not upselling.

It’s a live verification step to protect your progress.

Inside the Fundability Scan:

✔️ Real-time business identity review

✔️ Pass / caution / fix-first status

✔️ Priority correction roadmap before applying

Outcome:

You apply with confidence — not hope.

This dramatically reduces denials and buyer’s remorse.

💰 Total Real-World Value: $1,182+

💡 Even at $497, This Would Be a Steal

Think about it…

This system helps you unlock $50K–$100K+ in real business credit — even with bad credit or a brand new LLC.

If you walked into a funding consultant’s office, you'd pay $2,000+ just for advice — with no real tools, no done-for-you resources, and no results guaranteed.

But this isn't theory.

It's a proven, repeatable system that’s already helped thousands get funded — and it’s designed to do the same for you.

❌ Not $1,182

❌ Not Even $497

(Which would honestly be a deal.)

Originally Priced at: $97

That’s what we charged when we launched it privately to our inner circle.

To run your Funding Readiness Scan and unlock your personalized roadmap,

you get immediate access to:

✔️ The full 3X Business Credit System™

✔️ CreditMind AI™ diagnostic assistant

✔️ All execution tools and bonuses

One-time payment.

No subscription.

The “Get Funded or It’s Free”

Guarantee

We’re so confident this system will work for you — we’ll take on all the risk.

Here’s our simple promise:

If you go through the training…

Use CreditMind AI™ to scan and fix your file…

Follow the “Fix. Stack. Extract.” system…

…and don’t unlock at least $10K–$20K in real business credit, just email us.

We’ll refund your $37 no questions asked.

✅ You keep the entire system.

✅ You keep the CreditMind AI access.

✅ You keep all the bonuses.

We either help you get funded or it’s free.

There’s zero risk. Just upside.

💰 Total Combined Value: $1,182+

Act Now—It’s Only $37

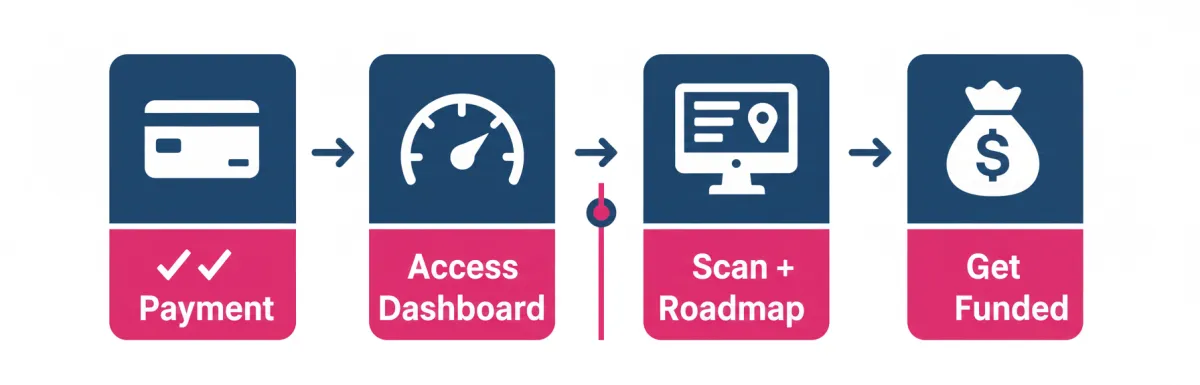

Here’s What Happens After You Click

The process is simple and immediate:

Your Member Dashboard Activates Instantly

Access the full 3X Business Credit System™ with the guided Fix → Stack → Extract path.

Your Funding Readiness Scan

Begins

Our system checks your business identity signals and shows exactly what needs to be corrected first.

Your Personalized Funding Roadmap is Generated

No guesswork. You’ll see your next steps in the right order — based on your business setup.

All Tools & Accelerators Unlock at

Once

Identity Compliance Pack, Sequencing Matrix, Vendor Vault, Float Strategy, Command Center, and Execution Tracker are live inside your portal.

Your Fundability Scan Session Opens for Scheduling

Select a time — we review your business file with you and confirm your approval path.