Unlock $50K–$100K in Real Business Credit — Fast.

Even if you’ve been denied before.

Even if your LLC is new.

Even if your personal credit isn’t perfect.

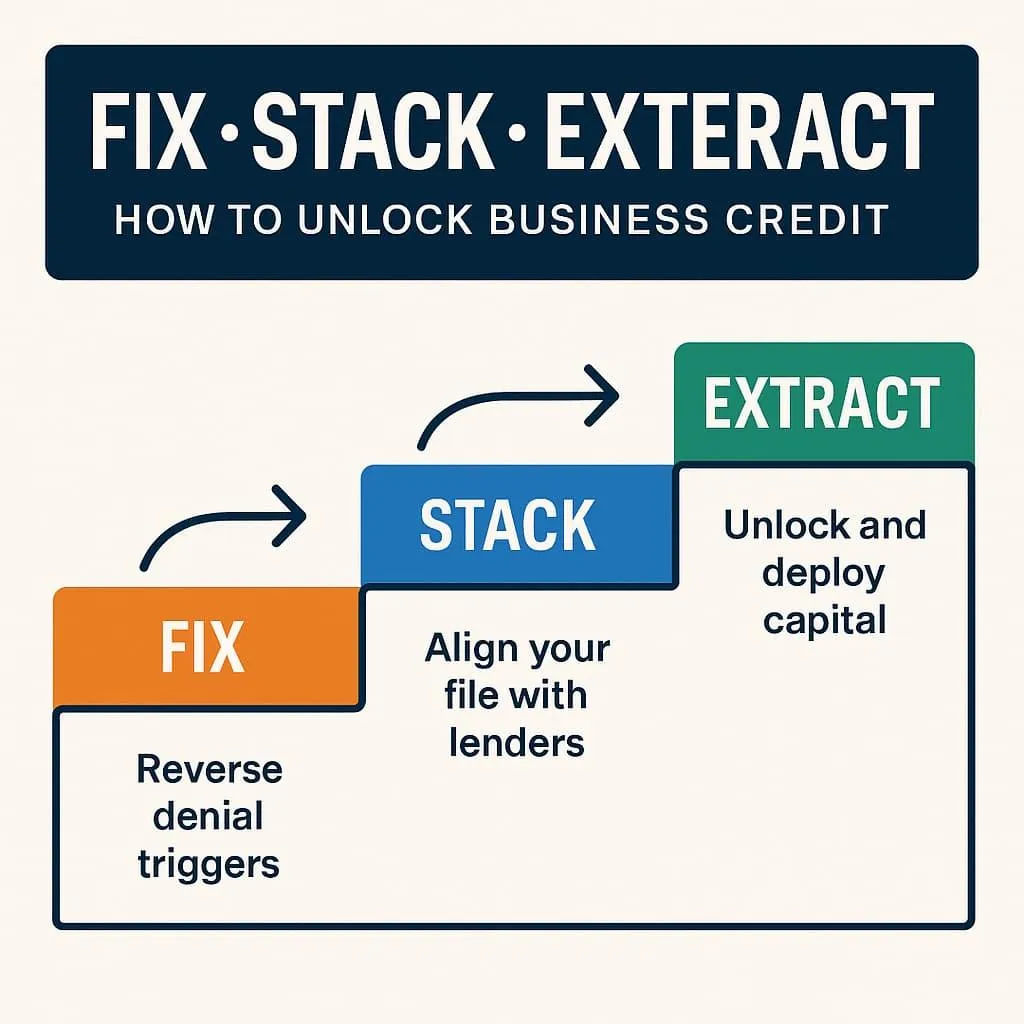

The 3X Business Credit System™

Fix. Stack. Extract.™

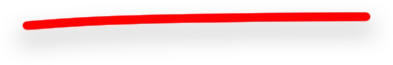

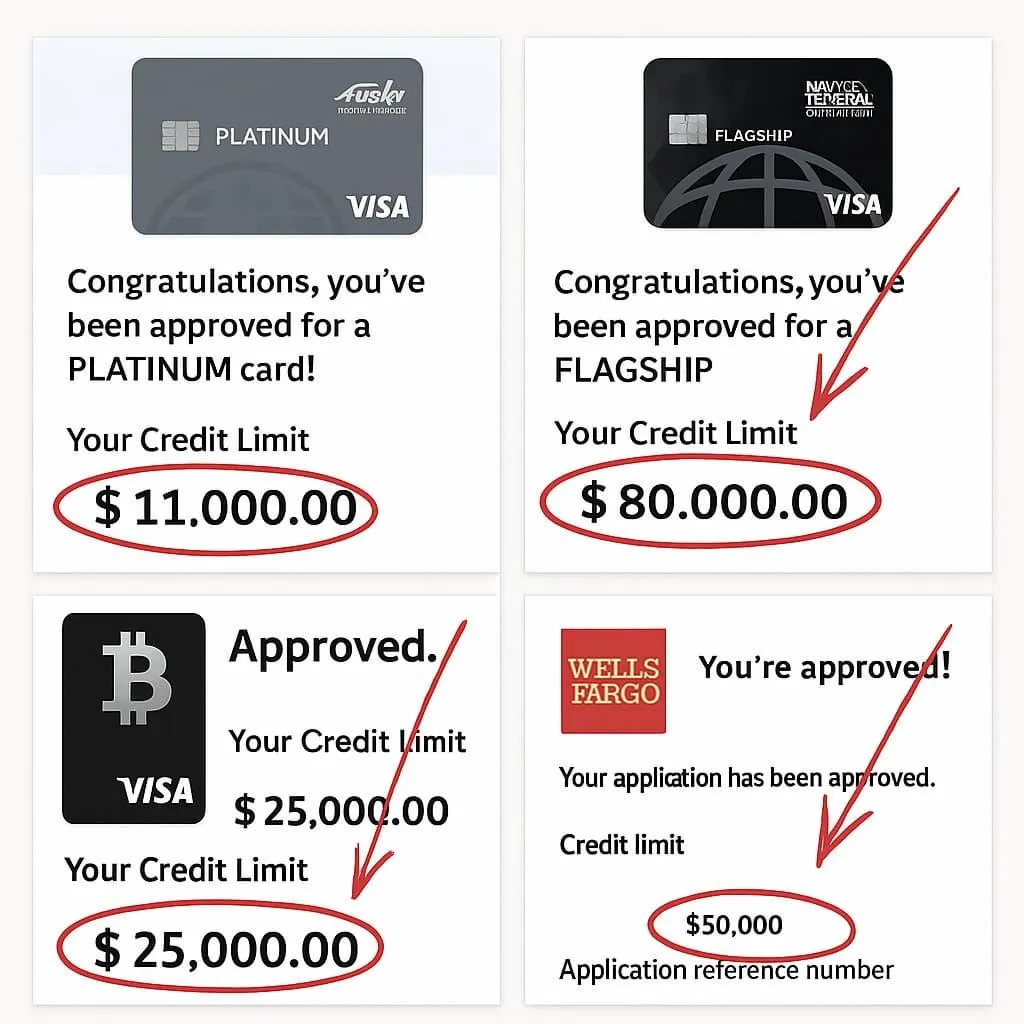

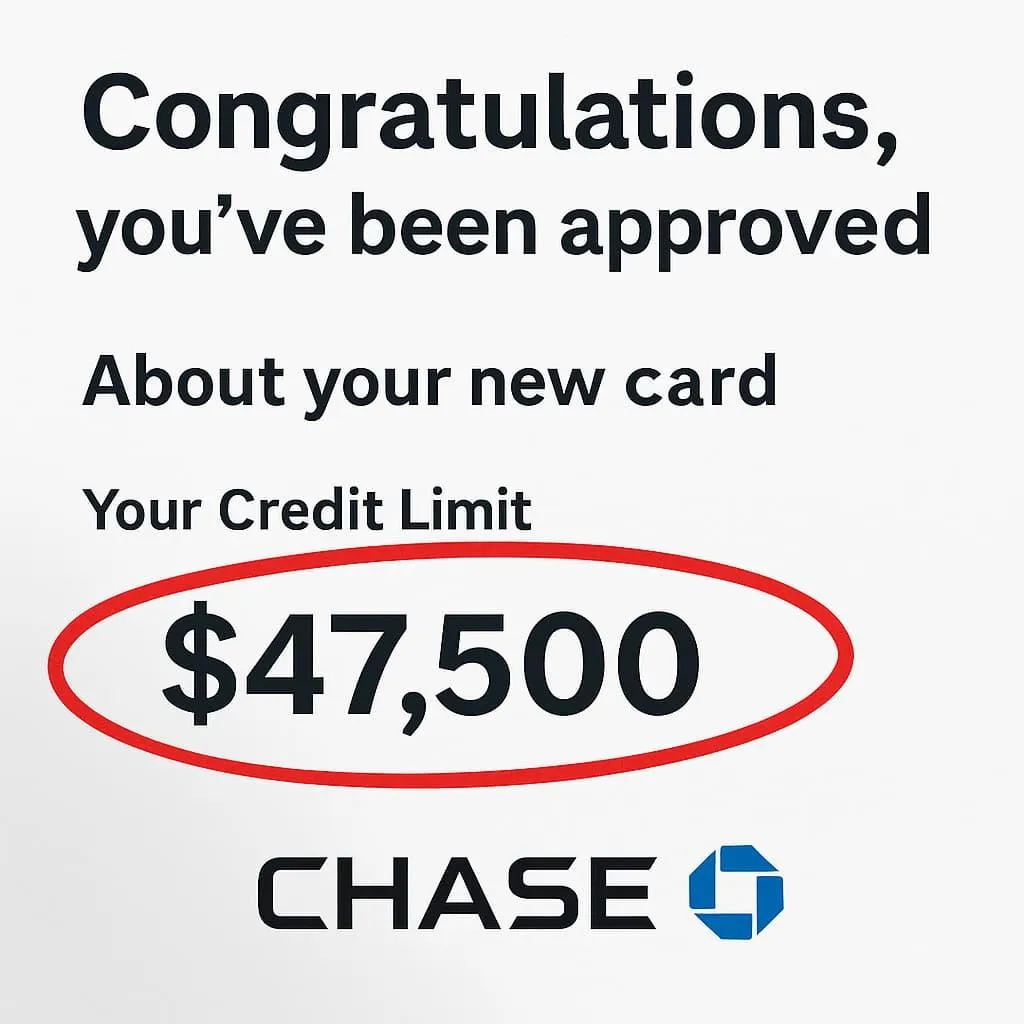

Get approved by real banks using the exact system that’s helped 4,700+ entrepreneurs unlock $50K–$100K in business credit under their EIN — not their SSN.

No begging.

No guesswork.

No “submit and pray.”

Just the signal banks are trained to approve.

😩 Why You’re Really Getting Denied (And It’s Not Your Fault)

And why it’s not your credit.

You’ve probably already…

✅ Formed your LLC

✅ Opened your business bank account

✅ Tried Net-30s

✅ Maybe even paid someone to “build your credit”

But the bank still tells you:

Application Denied.

Here’s the truth:

Banks aren’t reviewing your application. Their AI is.

And if your business identity data doesn’t match perfectly across their systems, the AI auto-rejects you in 0.3 seconds — before a human ever sees it.

This isn’t about:

Revenue

Time in business

Or your grind

It’s about the approval signal your business is sending.

Fix the signal → The approvals start.

Here’s What They Don’t Tell You:

Banks aren’t looking at your hustle.

They’re looking at your data — and 90% of denials happen before a human even sees your file.

Because their AI bots scan your application in seconds, and if they detect any of these:

❌ Mismatched business addresses across bureaus

❌ High-risk NAICS code (without you knowing it)

❌ Incomplete DUNS file

❌ Wrong business email (yes, this is real)

❌ No deposit history with the bank

❌ You applied to the wrong bank first and triggered a blacklist

You’re done.

And worse — you won’t even know why.

It’s not your fault.

It’s not about your credit.

It’s about the invisible “approval signal” you’re sending without even knowing it.

😤 Sound Familiar?

❌ You’ve been told to get Net-30s, but they didn’t report anything

❌ You opened a business account and still got denied

❌ You applied for Amex, Truist, or Divvy and got ghosted

❌ You’re watching people with brand new LLCs get $50K and wondering: WTF am I missing?

The truth is: they sent the right signal. You didn’t.

🔐 That’s What The 3X Business Credit System™ Fixes

✅ Fix. Stack. Extract.™ Method

This isn’t a course.

This is a precision funding system built to remove the hidden denial triggers that banks never tell you about — and replace them with the exact signals that underwriting AIs are trained to approve.

Inside the Fix. Stack. Extract.™ System, you’ll get:

✔️ The Fix Phase:

Clean the invisible data conflicts that cause instant auto-denials — even when your credit is good.

✔️ The Stack Phase:

Apply in a proven bank order that triggers internal trust scores and automatically unlocks larger approvals as you move up the ladder.

✔️ The Extract Phase:

Turn credit limits into real, spendable capital — safely — without triggering shutdowns, cash-advance flags, or account holds.

This is the same acquisition pattern responsible for unlocking over $100M+ in business funding across agencies, coaches, e-com brands, consultants, contractors, trucking, restaurants, service companies, and new LLCs with little or no history.

This alone is worth the entire investment.

Because once you know this pattern → funding becomes predictable.

Introducing the $100k Business Credit Playbook30™

🔥 What You Get Inside the 3X Business Credit System™

To complete your Funding Readiness Scan and unlock your personalized roadmap, you’ll get full access to the 3X Business Credit System™, CreditMind AI™, and all bonuses today for just $37.

The complete, step-by-step system that shows you exactly how to get $50K–$100K in real business credit under your EIN — not your SSN.

Inside, you’ll learn:

🔥 Fix – Clean the invisible red flags silently killing your applications

🔥 Stack – Apply in the exact lender order to unlock bigger approvals faster

🔥 Extract – Turn credit lines into usable cash for inventory, ads, or equipment

This is the blueprint behind over $100M in business funding unlocked — and it’s finally available for everyday entrepreneurs.

($497 Value — Included Today)

This is the proven Fix. Stack. Extract.™ method that turns your business into a bank-approved credit profile — even if you’ve been denied in the past.

✔️ The Fix Phase removes hidden denial triggers

✔️ The Stack Phase triggers approval momentum

✔️ The Extract Phase turns credit into deployable capital

This is the foundation.

You’re already set — this alone will get you funded.

But I don’t play small.

We’re going to make this stupid-simple to execute — no guesswork, no ‘trial and error’, no stress.

🎁 Bonus #1 — The Business Identity Compliance Pack™

($147 Value)

Make your business look credible, stable, and verifiable across every data source banks check — so automated underwriting stops flagging you as risky.

✔️ Authority Sheet™ Business Identity Template

✔️ Identity Sync Sweep SOP (14–28 Day Fix)

✔️ Red-Flag Decoder (18 Auto-Deny Triggers to Remove)

✅ Complete the Fix stage — become “AI-approved.”

🎁 Bonus #2 — The Approval Sequencing & Bank Target Matrix™

($197 Value)

Know exactly which banks to apply to — and in what order — to avoid denials and increase limit size automatically.

✔️ Capital Access Ladder™ (Phase 1 → Phase 3)

✔️ Tiered Bank & Lender Application Order

✔️ Relationship Signals That Trigger Higher Limits

✅ This powers Stack — your approval momentum.

🎁 Bonus #3 — The 0% APR Expansion & Float Strategy

($147 Value)

Turn credit limits into usable working capital without triggering shutdowns, cash-advance fees, or account reviews.

✔️ Safe Float Rotation Rhythm™

✔️ Statement Timing + Payment Strategy

✔️ Bank-Friendly Capital Access Paths

✅ This completes Extract — credit → capital.

🎁 Bonus #4 — The EIN-Only Vendor Starter Pack

($97 Value)

Start with vendors that actually report to business bureaus, so your company becomes visible and credible fast.

✔️ Verified Net-30 Starter Accounts

✔️ Reporting Timeline Expectations

✔️ Vendor Sequencing Map

✅ Fast-tracks Fix → Stack readiness.

🎁 Bonus #5 — The Credit Command Center Dashboard

($97 Value)

Manage your entire business credit profile in one simple control panel — no guesswork.

✔️ Trade Line & Reporting Tracker

✔️ Application & Inquiry Log

✔️ Deposit Rhythm & Banking Behavior Monitor

✅ Keeps you on track through every stage.

🎁 Bonus #6 — The Weekly Execution Tracker™ (28-Day Plan)

($47 Value)

Your day-by-day roadmap to becoming fundable — simple enough to hand to a VA.

✔️ Daily Action Checklist

✔️ Proof-of-Completion Upload Prompts

✔️ Fix → Stack → Apply Timeline

✅ Removes confusion — ensures progress.

🎁 Bonus #7 — CreditMind AI™ Diagnostic Assistant

($197 Value)

Upload your profile — get instant personalized fix steps and correction instructions.

✔️ Upload-Based File Scan

✔️ Fix-Order Repair Plan

✔️ Dispute/Correction Letter Generator

✅ Accelerates the Fix stage.

🎁 Bonus #8 — The Fundability Scan™ (Live Business File Check)

($197 Value)

We show you exactly what’s blocking your approvals — live — and give you your Fix-First Priority List.

✔️ Real-Time Business Credit Identity Review

✔️ Pass/Fail Eligibility Check

✔️ Priority Correction Roadmap

✅ Gives you certainty before applying.

💰 Total Real-World Value: $1,182+

💡 Even at $497, This Would Be a Steal

Think about it…

This system helps you unlock $50K–$100K+ in real business credit — even with bad credit or a brand new LLC.

If you walked into a funding consultant’s office, you'd pay $2,000+ just for advice — with no real tools, no done-for-you resources, and no results guaranteed.

But this isn't theory.

It's a proven, repeatable system that’s already helped thousands get funded — and it’s designed to do the same for you.

❌ Not $1,182

❌ Not Even $497

(Which would honestly be a deal.)

💵 Originally Priced at: $97

That’s what we charged when we launched it privately to our inner circle.

✅ But Today? Just $37

One-time payment.

One-time payment. No subscriptions. No hidden fees.

You’re getting the full 3X Business Credit System™, CreditMind AI™, and all the bonuses — for less than dinner and drinks.

💯 The “Get Funded or It’s Free” Guarantee

We’re so confident this system will work for you — we’ll take on all the risk.

Here’s our simple promise:

If you go through the training…

Use CreditMind AI™ to scan and fix your file…

Follow the “Fix. Stack. Extract.” system…

…and don’t unlock at least $10K–$20K in real business credit, just email us.

We’ll refund your $37 no questions asked.

✅ You keep the entire system.

✅ You keep the CreditMind AI access.

✅ You keep all the bonuses.

We either help you get funded or it’s free.

There’s zero risk. Just upside.

💰 Total Combined Value: $1,182+

Act Now—It’s Only $37

Here’s What Happens After You Click

🧾 Here’s What Happens the Moment You Join

The process is simple and immediate:

✅ Your Member Dashboard Activates Instantly

Access the full 3X Business Credit System™ with the guided Fix → Stack → Extract path.

✅ Your Funding Readiness Scan Begins

Our system checks your business identity signals and shows exactly what needs to be corrected first.

✅ Your Personalized Funding Roadmap is Generated

No guesswork. You’ll see your next steps in the right order — based on your business setup.

✅ All Tools & Accelerators Unlock at Once

Identity Compliance Pack, Sequencing Matrix, Vendor Vault, Float Strategy, Command Center, and Execution Tracker are live inside your portal.

✅ Your Fundability Scan Session Opens for Scheduling

Select a time — we review your business file with you and confirm your approval path.